What Is a Surety Bond, and How Much Does It Cost?

Surety bonds are an essential part of being a construction business owner, and having the proper bonding in place can make all the difference in acquiring work and building revenue, staying compliant with state law as well as staying in operation if your company ever doesn’t uphold its contractual obligations whether intentional or unintentional. Acquiring the right surety bonds can sound a bit overwhelming for new business owners, but the terms involved and path to obtaining them is actually quite simple.

What Is a Surety Bond?

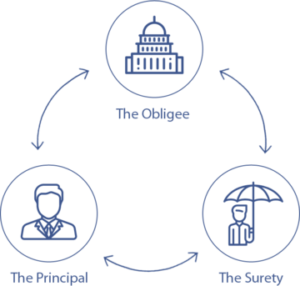

A surety bond is a binding contract between three parties: the principal, the surety, and the obligee. The principal is the party acquiring the bond (the contractor). The surety is the entity providing the bond, often an insurer. The obligee is the party requiring the bond as a means of guaranteeing that the principal will fulfill the terms of the contract. Obligees are often government agencies, but they can also be commercial or private parties.

Surety bonds typically fall under one of four categories: contract surety bonds, fidelity surety bonds, court bonds and commercial (or miscellaneous) surety bonds. Today, we are going to focus on the two categories most common in the construction industry- contract and commercial bonds. While each group is quite different, both can be viewed as a form of insurance.

For contract bonds, if the terms established by the bond are not met, such as not performing the work contractually agreed upon (performance bond) or failing to pay a supplier (payment bond), the entity harmed by a contractors actions may file a claim against their bond. The surety would then financially indemnify the party covered by the bond and harmed as a result of the principals actions, should the claim be deemed valid. The principal, however, is then required to reimburse the surety for the amount of the claim plus administration expenses. To ensure this pledge, the surety will typically require the principal to sign an indemnity agreement which outlines each parties responsibilities in the event of a claim. While not typical, in some instances the surety may require the pledging of the principals corporate and personal assets as collateral to protect itself.

Commercial bonds work in a similar fashion. The most common commercial bond for contractors in California is the contractors license bond and its required by the state as a condition for being licensed. It’s purpose is to protect the public in the event a contractor violates state law as outlined in the California Business and Professions code. Currently contractors are required to have a $25,000 license bond.

Who Does a Surety Bond Protect?

Surety bonds are generally not for the benefit of contractors but are typically used to protect the public or other parties from a contractors potentially harmful actions. Indirectly, they can help small contractors compete for contracts by reassuring customers that they will operate in an honest and ethical manner. To that point, a surety bond protects the public, as well as obligees and principals. Surety bonds directly protect parties defined by the obligee, but they can also protect the principal on the front end of a claim by ensuring disputes are resolved before costly lawsuits are filed.

What Is a Surety Company?

In most instances, a surety company is an insurer. A surety guarantees the obligee that funds owed by a principal will be paid in the event the principal does not fulfill the established contractual terms as with contract bonds, or they violate state law as with a license bond. Unlike more traditional insurance companies, a surety may assume a loss will occur and factors into consideration indemnity by the principal when establishing a premium. Unlike traditional insurance arrangements that do not require claims to be repaid, surety bonds function more like a loan by the surety on behalf of a principal than a form of insurance because they must be repaid in the event of a claim.

What Types of Surety Bonds Are There?

There are many bond types available, so acquiring the right one for your business depends on the project or license you are looking to get. The most common types of surety bonds a contractor may require include commercial bonds such as license bonds, and permit bonds, and contract bonds, including bid, performance and payment bonds.

License Bonds

License bonds are legal contracts designed to protect the general public by guaranteeing contractors will adhere to all state laws and regulations. A license bond is for the benefit of a contractor’s customers if they are financially harmed as a result of a contractor’s actions. License bonds include contractor’s license bonds, Bonds of Qualifying Individuals, LLC employee/worker bonds, and disciplinary bonds.

Permit Bonds

A permit bond is a type of commercial surety bond typically required by a local municipality, state, or federal agency as a condition for obtaining a permit for certain projects. Permit bonds provide a form of financial guarantee for the obligee that a contractor (or property owner) will comply with all applicable laws, ordinances, and building codes related to the project being performed, in much the same way as a license bond ensures ongoing legal compliance for contractors. Permit bonds include grading bonds, excavation bonds, and encroachment bonds.

Contract Bonds

Contract bonds are a broad group of surety bonds that guarantee a contract is fulfilled. Some of the more common types of contract bonds in the construction industry are bid bonds, performance bonds, payment bonds, and subdivision bonds. Contract bonds are most commonly required when working on government projects, though they can be required by private entities as well.

How Much Does a Surety Bond Cost?

There isn’t a flat rate for surety bonds. The premium a company will pay for a surety bond will be a percentage of the bond’s coverage amount, and several factors also influence what the premium will be, including:

- The credit health of the principal

- The type of bond needed and its relative level of risk

- The financial strength of the principal (assets vs. liabilities)

- The bond amount

- The individual surety provider

- The principal’s prior bond history

- The principal’s industry experience

All things being equal, smaller bond amounts have easier underwriting requirements such as a minimum qualifying credit score, while larger, riskier bonds may have additional requirements including a review of personal and business financials. To see what your premium will be for the bond you need, it’s best to contact a surety to get a quote.

How Do Surety Bonds Benefit You?

There are several benefits to obtaining a surety bond. In most instances, getting a surety bond is not a choice but is required as a condition for being licensed or obtaining a contract. Being licensed and bonded will provide several key benefits by allowing you to meet the requirements of obligees, instilling customer confidence and winning your company more contracts. You’ll also avoid the penalties of operating without the proper bonds, which can include criminal charges and hefty fines.

Some bond alternatives include posting cash or a certificate of deposit in lieu of a bond. There are disadvantages to this including:

- 100% Collateral Risk: Instead of a surety providing a guarantee, your assets will be on the line.

- Higher Costs: Though you won’t pay a bond premium, you risk unexpected costs that could be a bigger financial burden than the premium would have been.

- Decreased Capital: Posting your own assets instead of purchasing a bond decreases your liquidity. This risk can potentially lead to defaulting on a contract or going bankrupt.

- False Claims: You won’t have the same protections. If a claim is brought against your company, you’ll be at higher risk of overpaying.

How Do You Know If You Need a Surety Bond?

There are varying reasons to get a surety bond, but you’ll know you need one if an obligee you want to work with or another entity you are responsible to requires one. Some government agencies require a particular bond to guarantee that you’ll do your job in compliance with applicable laws or complete a task as contracted. In most cases, surety bonds are purchased to satisfy occupational licensing requirements set out by a federal, state, or local government authority or to satisfy requirements for private contracts.

What Does the Process of Getting a Surety Bond Look Like?

After determining the type of bond you are required to have, you need to then understand what the requirements are in your specific area. It’s helpful to contact your state or local licensing authority or the obligee requesting the bond to ask which category of bond you need and in what amount. At Surety First, we can help you determine your bonding requirements.

Our team has years of experience and makes the process of obtaining a bond smooth and fast. You can be sure that you are getting a competitive, secure, and highly rated contractor bond from our knowledgeable team. Our bonds are electronically filed with the Contractors State License Board to save you time and hassle, and many of our bonds are available with financing options. Financing options and availability vary between bond companies. If financing is available for an online quote, it will appear along with the pay-in-full option.

Get a quick and easy bond quote from the Surety First team, or learn more about the bonds you may need at 1-800-682-1552.

HAVE BONDING QUESTIONS?

Call us today at 1-800-682-1552 to speak with a licensed contractors bond specialist.

Mon-Fri 8:30am-5:00pm

Or