What Is A Payment Bond?

A payment bond is a type of surety bond that guarantees a contractor’s material suppliers and subs are paid according to contract. It is very commonly used on public projects where mechanics liens are not allowed. A payment bond is also a type of contract bond that is often packaged with a performance bond by many sureties. The need for a performance bond and payment bond often arises out of a contractor successfully winning a public or government job opportunity and posting a bid bond in the process. To find available government projects in your area, click here.

Why Do You Need a Payment Bond?

The primary reason that you need payment bonds, is that similar to performance bonds, they are usually required upon winning a bid for a public construction project. Payment bonds are essential in ensuring that subcontractors and suppliers are paid according to the terms laid out in their contracts. This means that even if problems arise, other parties involved in the process will not suffer financial loss. One of the main benefits of having a payment bond, is that they make it much more appealing for subcontractors and suppliers to work with you, knowing that they will not potentially suffer as a result. When these parties work with unbonded contractors, they take a significant level of risk on themselves, that if problems arise, they may not be compensated for their involvement and could be seriously financially affected.

How Does a Payment Bond Work?

Payment bonds are purchased by contractors, from a surety, who they pay a premium relative to the bond requirement. The bond then acts as a guarantee that if an issue arises, the parties involved in a project can be repaid for damages up to the required amount of the bond. This protects everyone involved in the project from potential liability and ensures ahead of time that the contractor is prepared for potential problems.

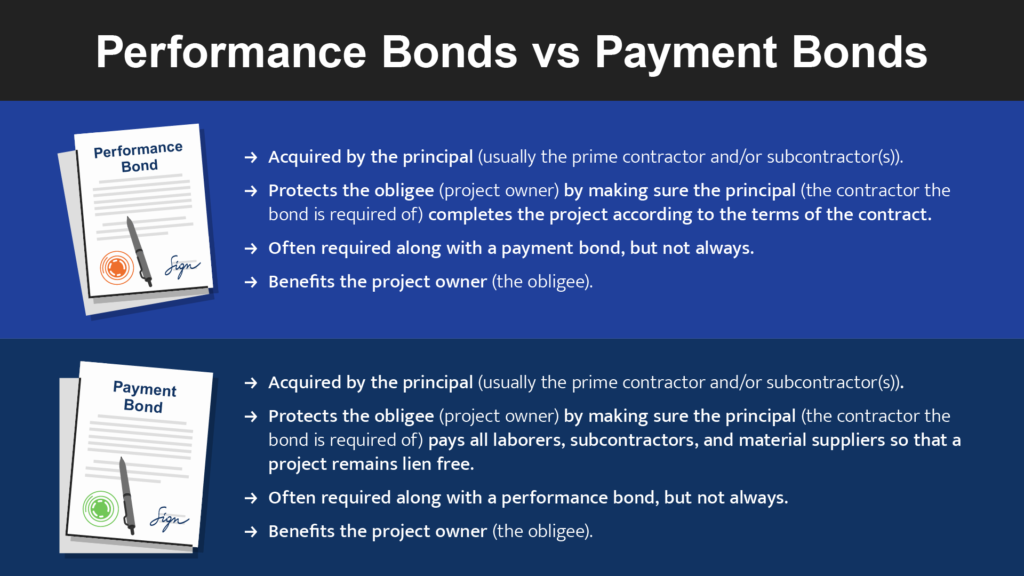

Payment Bonds vs Performance Bonds: What Is the Difference?

Payment and performance bonds are similar, but they are not the same thing. The confusion between them often arises from the fact that they are generally purchased together and can both be required after winning a bid. Payment bonds ensure that contractors pay their material suppliers and subcontractors according to their contracts. Performance bonds provide a financial guarantee to project owners that their contractor will perform according to contract terms. Both payment and performance bonds are generally required on public projects.

How Much Does A Payment Bond Cost?

Payment bond costs can vary but are often around 3% of the contract amount assuming the applicant has sound financials. For example, if your bond requirement is for $200,000, then a 3% premium would translate to a $6,000 bond cost. Construction payment bond costs will depend on several factors including the financial strength, credit score and experience of the contractor requesting the bond.

What Other Bonds Are Needed Alongside a Payment Bond?

Payment bonds are usually purchased alongside performance bonds by contractors who already have a license bond. License bonds are required for contractors to legally operate, and the other types of bonds required, will depend on the types of projects that a contractor takes on. Some jobs, especially public projects, will have more strict bonding requirements, where other jobs may not.

How Do You Get a Payment Bond Quote?

Getting a construction payment bond quote is simple. Just complete the quote form on this page and a Schaedler Insurance contract bond specialist will follow up with you promptly to provide the appropriate application for your particular bonding needs and answer any questions you may have. In a rush? Call our office now at 1-800-682-1552 and we can expedite your application with our underwriters.

What Is a Payment Bond Claim?

If during the course of a project, an issue arises involving the payment of a subcontractor, supplier, or other party, the wronged party can file a claim on the payment bond. If the claim is valid and a breach of contract has occurred, then the surety that issued the payment bond will compensate the wronged party for any damages they might have incurred.