California Contractors License Bond Guide

As of January 1st, 2023, the California Contractors License Board increased the license bond requirement from $15,000 to $25,000. This bond is required by the CSLB to protect the general public and ensure contractors follow state law in their business activities. Learn more about how they work, the costs involved, and other types of bonds that are required for contractors.

What Are Contractor License Bonds?

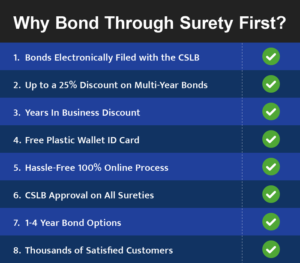

The California Contractors State License Board (CSLB) requires all licensed contractors or license applicants to obtain a $25,000 license bond, or bond equivalent, as a condition for being licensed. As outlined in section 7071.6 of the California Business & Professions code, the bond is for the benefit of a contractor’s customers if they are financially harmed as a result of a contractor’s actions. Surety First works hard to simplify the bonding process by providing instant online quotes for a contractor license bond without having to fill out dozens of paper applications. Getting a quote is free and fast, and there is no obligation to purchase.

Why Is a License Bond Required?

Contractor license bonds are legal contracts designed to protect the general public by guaranteeing contractors will adhere to all state laws and regulations as outlined in the California Business & Professions code or risk a bond payout, which in addition to resulting in a financial loss, can result in disciplinary action by the CSLB. Unlicensed contractors are not bonded and as such, do not provide the same level of financial protection to consumers. Each year the California Contractors License Board receives thousands of complaints regarding unlicensed contractors and they regularly conduct sting operations designed to catch and prosecute these offenders.

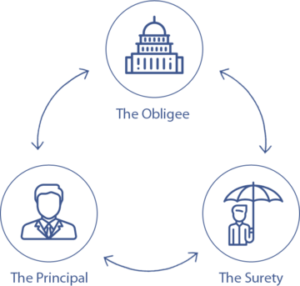

What Parties Are Involved in the Bonding Process?

A contractor license bond is a three-party contract between the contractor (the principal), the entity requiring the bond, which is called the obligee (The State of California – Contractors State License Board), and the surety (the insurance company writing the bond). The surety provides a financial guarantee in the amount of $25,000 to the obligee that the principal will obey state laws or risk a bond payout, which must be reimbursed by the contractor to the surety. In addition, all surety’s providing license bonds must be on the approved carrier list by the California Department of Insurance and are posted by the CSLB on their website. All bond carriers Surety First works with are on the approved list, so you can bond with confidence.

How Do Contractors License Bonds Work in California?

Contractor license bonds provide a financial guarantee to the state of California to ensure contractors operate in a legal and ethical manner. If a contractor’s customer is financially harmed as a result of a state law violation, then a bond payout may occur. An example of a bond claim could occur if, for example, a contractor obtained a deposit from a customer to build a new deck and they failed to complete the work as outlined in the contract. In this instance, a customer could file a claim against the contractors bond.

Before a surety makes a payout on a bond, it will investigate the claim and its validity, sometimes in conjunction with a CSLB initiated investigation. If a payout does occur, the contractor is responsible for repaying the surety the amount of the bond claim plus legal expenses, unlike with typical insurance. To avoid bond claims, contractors are well-advised to communicate with and resolve disputes with customers before they become bond claims whenever possible.

How Much Does a California Contractors License Bond Cost?

While each surety will use a combination of proprietary rating factors in determining rates, the cost of a contractor license bond depends largely on the applicant’s credit score at the time of the application, with average annualized rates starting at under $100 for well-qualified applicants. Other rating factors also apply. With just a few pieces of information, Surety First can provide a quick and easy online quote.

How Does the Bond Contract Wording Impact It’s Cost?

The CSLB requires all license bonds be completed on form 13b-1, which must be filed with the registrar as a condition for being licensed. These bonds are continuous unless cancelled. Unlike most insurance contracts, which will vary considerably in terms of what is covered, contract language will appear somewhat more similar between surety contracts, though not identical. Contractors should carefully review any contract language outlined in the indemnity agreement prior to purchasing a bond to ensure they are fully aware of its terms and conditions, including cancellation provisions, aggregate limits, and forfeiture clauses.

What Is Form 13b-1?

Form 13b-1 is designed to outline the rights and responsibilities between the Principle (the contractor), the Obligee (The State of California Contractors License Board) and the surety with regards to the provisions of the bond as outlined in Business and Professions Code 7071.5-7071.11. The $25,000 license bond is for the benefit of the employees or the customers should they suffer financial damages as a result of the contractors actions. In addition, form 13b-1 should not be confused with a contractors bond indemnity agreement, which is an agreement between the contractor and the surety with respect to rights and responsibilities as part of the bond contract, with provisions provided should a claim occur.

Aggregate Limits

Unlike insurance contracts where aggregate limits may vary, a contractor license bond is always in the state-mandated amount, which is currently $25,000. Bond forms include a penal sum, which is the maximum amount of financial damages a single party can recover from the bond in reference to a single claim. Many bond forms also include a clause that limits the amount of financial damages from all parties and claims to a specific amount, called the aggregate limit. Aggregate limits of contractor license bonds are outlined in section 7071.5 and 7071.6 of the California Business & Professions code.

Cancellation Provisions

Cancellation provisions allow surety carriers to cancel a bond for any reason, usually due to failure to pay premiums or changes in credit, but also as a result of unresolved bond claims. The surety must provide formal notice to the contractor or agency that the cancellation will be taking effect at a certain time, often 30 days from the time of notice. Bonds with no cancellation provisions will generally be more expensive.

Forfeiture Clause

Whereas many bond claims are paid by the surety carrier to the damaged party up to the bond amount, a bond can contain a forfeiture clause that requires the surety to pay the full bond penalty to the damaged party, regardless of the damages. Bonds with this clause will also be more expensive.

Does Credit Matter When Applying for a License Bond?

Yes. The surety will run a credit report because the contractor is responsible for reimbursing the surety bond carrier if any claims are made on a bond. Credit is a primary rating factor in determining license bond rates. Despite this, contractors with bad credit can still be bonded in most cases.

Can Contractor License Bonds Be Transferred?

No, contractor license bonds are not transferable between business entities. If a contractor changes its business entity, it will need to purchase a new bond.

How Does a Contractors License Bond Differ From Insurance?

The primary difference between insurance and a contractor license bond is that the bond is used to protect consumers from a contractor’s unlawful actions, while insurance is used to protect a contractor from unexpected business-related liability exposures. Another key difference is that a contractor license bond is required as a condition for being licensed, while liability insurance is generally not unless the contractor is organized as an LLC. Insurance also differs from a contractor license bond in that it does not have to be paid back in the event of damage or injury. Ideally, a contractor should be both bonded and insured.

How Long Is A California Contractors License Bond Valid?

A contractor’s license bond can be valid for as little as one year or as many as five years depending on the surety and how many years were purchased in advance by the principal. California contractors with good credit usually have an opportunity to purchase a license bond with a term of several years, while those with poor or marginal credit generally are not offered bond terms greater than one year.

Do Contractors Need to Re-Qualify for New Bonds When They Expire?

It’s important to note that whether a bond has a term of one year or several years, all contractors must re-qualify for a new bond when their current bond expires. When this occurs, contractors often experience large premium fluctuations both up and down as compared to their prior bond due to changes in their credit profile or other rating factors. In these situations, they may be well advised to purchase multi-year bonds when available to avoid premium rate fluctuation risk.

How Do Contractors Check Their License and Bond Status With the CSLB?

Contractors can check their license status by inputting their license number in the license status field located here on the CSLB website. For additional bond requirement information, please refer to the Contractors State License Board’s list of license and bond requirements.

What Other Types of Bonds Are Required for Contractors?

Depending on how a business is organized, additional bond requirements may apply. Businesses organized as an LLC require a $100,000 LLC employee/worker bond in addition to other bond requirements. In addition, some contractors must also hold a bond of qualifying individual and/or a disciplinary bond.

Bond of Qualifying Individual

A bond of qualifying individual is required if a license is qualified by a responsible managing employee (RME) or a responsible managing officer (RMO) that does not own at least 10% of the voting stock of a corporation. An RME must not be the qualifier for another license and must be a bona fide employee of the business and employed for at least 32 hours per week, or 80% of the business’s operating hours, whichever is less. Contractors that have a license that is not qualified by an RMO or RME do not require a BQI.

Disciplinary Bond

Contractors that have violated state law, resulting in the revocation of their license, may be required to carry a disciplinary bond if they want their license to be reissued or reinstated by the CSLB. This bond is in addition to a contractor license bond. The amount varies depending on the severity of the contractor’s infraction.

LLC Employee/Worker Bond

California contractors organized as an LLC in California are required to maintain a $100,000 LLC/Employee work bond as a condition for being licensed in addition to a license bond. The bond protects workers of the organization against unpaid wages and or benefits they are owed.