What Is a Bid Bond? A Contractor’s Guide to Understanding Bid Bonds

Making sure that any given project is properly protected is important to project owners. A bid bond is one of the most important bonds that contractors and their clients should be aware of and is a required part of bidding on many types of projects, including government projects.

Find available government projects in your area here, and learn more about how bid bonds work, associated costs, and ways to prevent claims by continuing on below.

What Is a Bid Bond?

A bid bond is a type of contract bond typically found in the construction industry with the function of holding contractors accountable for the bids they submit.

In earlier times when bid bonds were less common, project developers would often award projects to contractors that had underbid their proposals intentionally or through negligence, which forced developers into renegotiating terms with their contractor after the fact, or go back to the drawing board to hire a new firm. Both options are expensive and time consuming as developers have sunk costs in putting a project out to bid.

Why Are Bid Bonds Necessary?

Bid bonds provide a simple fix to the problem of underbid contracts. For bonded projects, contractors are required to submit one with their proposal or it will be rejected. Should a contractor underbid a project they are awarded, they may be unable to attain a performance bond required to continue the project or simply walk away from the job before incurring financial losses. As a result, the developer can file a claim against the contractors bid bond and terminate their contract.

In the event of a valid bond claim, bid bonds are fully indemnified, meaning a contractor is required to repay the surety the amount of any claim plus expenses out of business or personal assets pledged in the bond agreement. With this in mind, it’s very important to understand how they work to avoid problems down the road. Read on to see bid bonds explained!

How Does a Bid Bond Work?

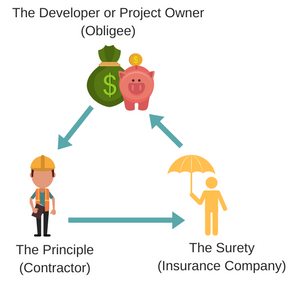

Bid bonds are a type of three-party financial arrangement whereby an obligee (typically the developer or government agency doing the project) requires a principal (the contractor) to obtain a bond, usually from a surety which in practice is often an insurance company.

The bid bond guarantees the developer that if the principle is awarded the job, he or she will fulfill the terms of the contract including obtaining any other bond requirements such as a performance bond and a payment bond.

Who Benefits From A Bid Bond?

Unlike insurance which is for the benefit of the business that carries the policy (the principle), bid bonds are required for the benefit of the entity requiring them, the obligee (the developer/project owner).

However, indirectly, a bid bond can subtly benefit a contractor by giving them a very clear idea on the size and type of projects their surety feels comfortable bonding them for. As a result, contractors who consistently work bonded projects can avoid getting in over their head bidding on projects for which they do not have the financial capacity or experience to complete simply by having their surety audit their business activities and financial status as part of the bonding process.

How Is the Amount of a Construction Bid Bond Determined?

The amount for each bid bond request will vary between projects but very commonly it will be 5-10% of the total contract price. One bid bond example is that a $100,000 contract may require a $10,000 bond (assuming a 10% requirement.)

The reason a bid bond is much smaller than the total contract is that in the event of a claim, an obligee would incur damages amounting not to the full contract price, but the difference between the lowest bid proposal and the second lowest bidder. A 5% or 10% bid bond is usually sufficient to cover this spread in the event of a claim.

What Is The Process For Obtaining A Bid Bond?

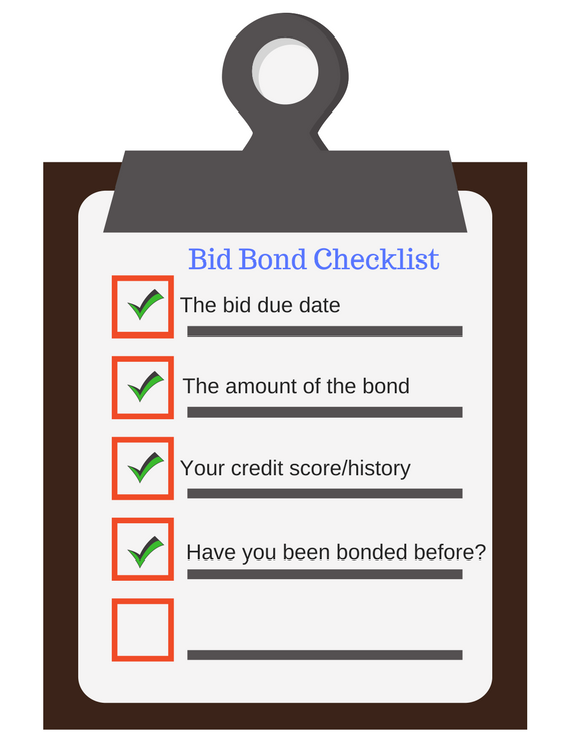

If you’re wondering how to get a bid bond, it’s actually relatively simple. The first step is qualifying for the bond you need for a particular project. To get started, we will need the due date of the bid bond, the amount, your credit history, and whether or not you have been bonded before.

How Do You Qualify for a Bid Bond?

Small amounts of under $100,000 require a simplified application process where a surety will often evaluate an applicant primarily based on their credit and industry experience. These bonds are both simple and fast to execute should a contractor meet general qualification guidelines.

Larger bonds will have additional requirements including a review of the contractors financial background and industry experience, in addition to their credit history. Larger bonds are riskier for surety’s and as such, they will take a bit longer to underwrite and are more difficult to qualify for.

If a contractor is applying for a bid bond for the first time, it’s important to allow for at least a day or two to underwrite small accounts under 100k and up to a week or so for large accounts up to or exceeding a 1 million dollar request amount. Utilizing a cpa to prepare any required financial statements is very smart.

The first time through applying for a bonded project will give a contractor a solid idea on the size of projects their surety is comfortable extending bonding for based on their experience and financial status. As a whole, this number is often referred to as a “bond line” and is very useful in letting a contractor know what size of projects they can potentially qualify to bid on.

Can You Get a Construction Bid Bond With Poor Credit?

While it is ideal to have good credit when seeking a bond line, it is possible to obtain one with poor credit. That said, it will typically cost more since the lender will see it as a greater risk.

What Is a Bond Line?

Obtaining a bond line can be thought of in terms of obtaining a line of credit from a bank. Simply put, your aggregate bond line is the total amount of bonding your surety is willing to extend you across all bonding jobs based on their underwriting evaluation of your credit, experience and overall financial status. Your single limit bond line is the largest single project your surety is willing to bond you for.

Many contractors entertaining the prospect of working bonded projects would be well advised to seek a letter of bond-ability from their insurance broker prior to bidding on their first project. This letter is not project specific and will give contractors a good idea on the size of projects their surety is comfortable bonding them for based on a review of their credit, financial status and industry experience.

How Much Does A Bid Bond Cost?

The cost of a bid bond varies between surety’s, but is generally very inexpensive. Some don’t charge a fee while others charge a flat, nominal fee of a few hundred dollars, which often covers all projects a contractor may bid on during a year.

Bid bond companies understand that a performance bond will subsequently be required and will be significantly more costly than the bid bond (usually 1.5%-3% of the total requirement).

It is expected that should a surety provide a bid bond and the contractor is awarded the project, they will also be providing the performance bond should the contractor qualify. Your surety can be your greatest ally if you work to build this relationship.

Bid Bonds vs Performance Bonds

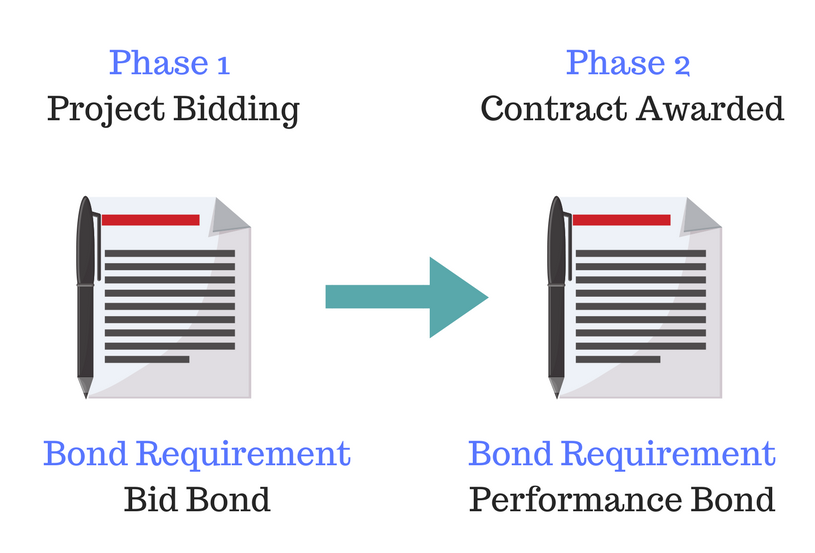

When it comes to bid bonds and performance bonds, it can be easy to confuse the two. As mentioned previously, a bid bond holds contractors accountable for their bid proposals. Performance bonds, in contrast, ensure that a contractor awarded a project completes it according to the terms of the contract. With this is in mind, when a bid bond is required, it will typically always be followed by a performance requirement. Also, bid bonds do not automatically convert to performance bonds in most states, with the exception of Ohio.

Choosing a bid bond surety based solely on the pricing structure for this bond is generally not the best idea for many reasons as we will go over shortly. With this in mind, how should a surety be selected for these or other contract bonds if the price is not the sole criteria?

Bid Bonds vs Contract Bonds

As noted above, a bid bond is a specific type of contract bond. Other types include performance, payment, and subdivision bonds. Basically, it refers to those that are bound by the completion of a contract.

How Do You Choose Between Sureties?

Choosing which surety to begin working with can be expedited by the help of your insurance broker. Each surety has their own underwriting guidelines for the specific profile of contractor they are most comfortable working with which we can expedite based on gathering some preliminary information about your business, credit and industry experience.

Our goal is to facilitate an ongoing relationship with your surety whereby you can grow your bonding capacity over time under the most favorable terms possible. This philosophy empowers contractors to gradually bid on larger projects once a proven track record of success and improving financials has been established.

Finalizing Your Bond

Once you have satisfactorily completed the underwriting process and your bid bond has been approved, the next step is submitting it along with your contract proposal. At this stage, it’s critically important that your proposal is accurate prior to submitting it. This is the most important step in preventing bond claims.

How To Prevent Claims

Bid bond claims can occur for many reasons with errors in the bidding process the root cause of many claims. For example, surety’s may carefully evaluate a contractors proposal in comparison to engineers estimates provided by the developer and question why a contractors proposal is significantly less than the engineers estimate, presuming this scenario exists. This can be a big red flag than an error in bidding may have occurred.

When a contractor realizes they may have critically underbid their proposal, the first question contractors may have is what recourse exists to withdrawal their proposal without penalty.

Can You Withdraw a Bid Bond?

Bid bonds typically cannot be withdrawn after a proposal has been submitted and the project has been opened for bidding. However, if an error was caught after submitting a proposal, but prior to the job being awarded, a developer may consider the circumstances in allowing the proposal to be edited without penalty. This is not typical and is generally at the developers discretion.

Once again, submitting accurate bid proposals is crucial when bidding bonded projects as the consequences for having a contract canceled are severe.

Are Bid Bonds Returned?

Yes, once the project has been completed under the terms of the contract, the bond amount will be returned. In addition, they are refundable if the bid is not won. In this case, the obligee has decided to proceed with another contractor instead so a bond will not be needed.