California Workers’ Compensation Insurance Guide

Workers’ compensation insurance is important coverage that is required of all businesses that have employees in order to protect them from work-related injuries or illnesses. Learn more about California workers’ compensation insurance works, obtaining coverage, and whether or not you need workers’ compensation insurance for your business.

What Is Workers’ Compensation Insurance?

Workers’ compensation insurance is a form of insurance that provides protection in case of accidents involving work-related injuries or illness. In the event that an employee is injured or falls ill on the job, workers’ compensation insurance provides the employee with necessary medical benefits and lost wages. If an employee is killed on the job, this insurance also covers death benefits for the family. Workers’ compensation insurance relies on a social contract between an employer and its workers. In exchange for offering this coverage, workers in many states can’t file a suit against the employer if injured or made ill during the course of their job.

What Does California Workers’ Compensation Insurance Cover?

Workers’ compensation covers:

- Medical bills

- A portion of lost wages

- Funeral expenses

- Rehabilitation services

For the benefit of employers, workers’ compensation insurance policies often also include employer’s liability insurance that will cover attorney’s fees, court costs, and settlement fees should an employee file a suit against the employer. This makes workers’ compensation a critical coverage to have. For fuller coverage in the event of workplace accidents, general liability insurance is also recommended.

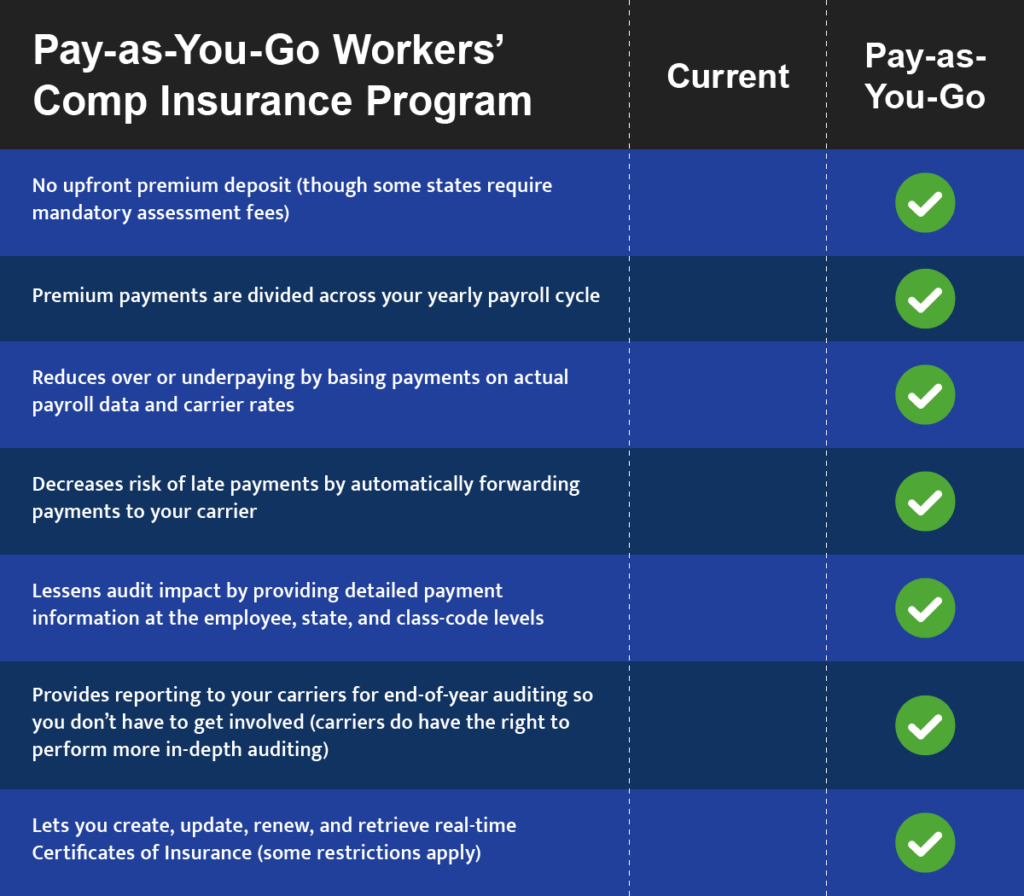

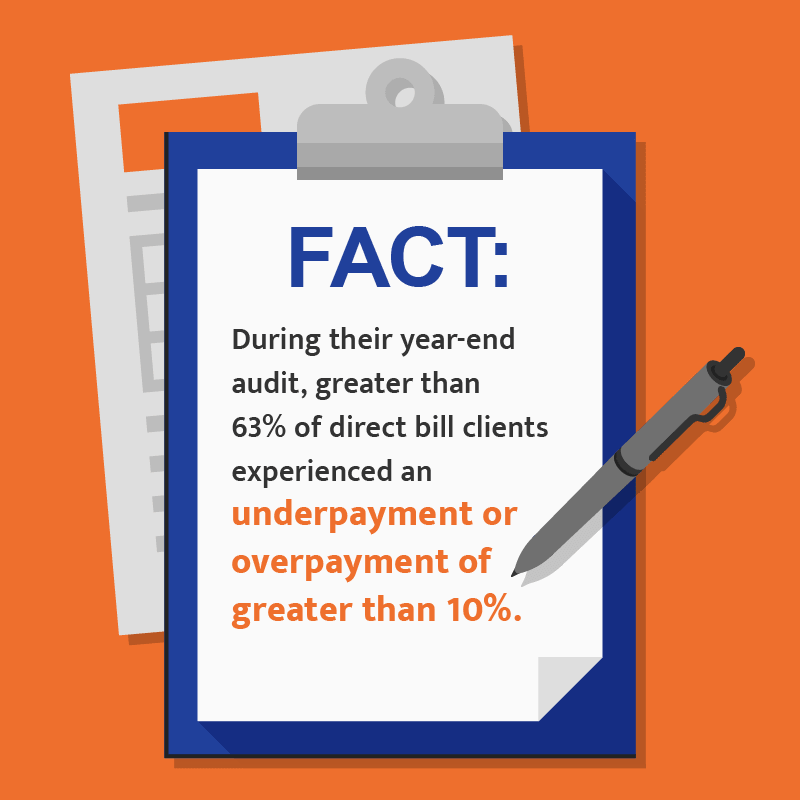

Pay-As-You-Go Workers’ Compensation Insurance

Pay-as-you-go workers’ compensation insurance programs eliminate the need for businesses to post large upfront deposits for their workers’ comp policies, among other key benefits. To take advantage of this program for our clients, Surety First has partnered with Thimble to package workers’ comp, payroll administration, and general liability insurance, if requested, into a single, simplified monthly bill.

Does California Workers’ Compensation Insurance Cover COVID-19?

For an illness to be covered by workers’ compensation, it must be proven to have arisen out of and in the course of employment. There are certain instances when COVID-19 could meet this requirement, including:

- If there is a direct connection between the job and illness

- The illness can be reliably traced to employment as the cause

- The illness does not arise from a condition workers would have been exposed to outside of employment

Learn more about how COVID-19 relates to workers’ compensation insurance.

Is Workers’ Comp Required in California?

In most states, including California, workers’ compensation coverage is required for any business that has non-owner employees from the start date of the first employee. California workers’ compensation insurance coverage is required for any business that has non-owner employees from the start date of the first employee. This is a common requirement for most states to protect businesses and employees. In some states, coverage is not required until a business has multiple employees. Businesses that do not provide this coverage in required states can face costly consequences, including having to pay for claims out of pocket, fines, imprisonment, and loss of the right to conduct business in the state.

Is Workers’ Comp Insurance for Small Businesses in California Worth It?

Small businesses can greatly benefit from workers’ compensation insurance. Since small businesses are typically more financially vulnerable than larger businesses, the consequences of a claim can have a great impact. Without coverage, a small business will have to pay for any fees that result from the claim out of pocket, which could be detrimental to a small company.

Does a Small Business Need Workers’ Comp for Only One Employee?

In California, the penalty for not providing workers’ compensation for all employees includes a fine of no less than $10,000 and up to $100,000, one year in jail, or both. Requirements vary by state but for most states, coverage is expected by law upon hiring the first employee.

Do I Need Coverage for Contract Workers?

Workers’ compensation insurance benefits are generally for W2 employees. Independent contractors typically do not qualify for benefits. Your insurance provider can help you understand state laws and coverage specifics for your business.

How Does Workers’ Comp Insurance Work?

If injured or fallen ill on the job, an employee must immediately visit a healthcare professional who will provide any necessary medical reports to support the claim. With the proper paperwork, the employee can then file the claim with the insurance provider. Once the claim is approved, the employee will begin receiving coverage benefits.

How Much Does Workers’ Compensation Insurance Cost in California?

The cost of workers’ compensation depends on several factors, including:

- Payroll

- Location

- Number of employees

- Industry and risk

- Coverage limits

- Claims history

Note that businesses with a claims history are typically charged with higher premiums.

Workers’ Comp Insurance Cost for Small Businesses

In each state, small businesses with comparable workplace risk factors and costs are grouped into classes. Loss costs for the previous five years are evaluated for all businesses within that class. Rates are determined per class according to this evaluation.

Is Workers’ Comp Insurance Required by Law?

In most states, yes. Texas is currently the only state in which workers’ compensation coverage is never required. View workers’ compensation requirements by state.

Workers’ Compensation Insurance Requirements for California

Employers in California are required by law to provide workers’ compensation insurance, even if they only employ one worker. This workers’ comp insurance covers medical care, temporary disability benefits, permanent disability benefits, supplemental job displacement benefits, a return-to-work supplement, and death benefits. Learn more about California’s workers’ comp requirements.

How Do I Get Workers’ Compensation Insurance?

You can easily get workers’ compensation insurance by contacting a qualified insurance provider. Our team of specialists at Surety First is here to speak with you about the requirements and recommendations that relate to your business, as well as provide you with a fast, online quote. Get a quote now.