How Far You Can Go on the Median Income in the 50 Largest U.S. Cities

It’s important to have a firm understanding of your expenses before you make the decision to take on a construction project. We work with contractors on a daily basis to find the best solutions for their bonding and insurance needs, so see many financial scenarios with varying amounts of discretionary income available to take on projects.

Discretionary income is a factor in financial decision making for individuals too. Whether you’re considering a move, starting your own business, or planning for any other investment, having an understanding of your discretionary income is important. In order to get a better understanding of the monthly discretionary income available for individuals and families around the country, we performed an analysis to determine how far the median income goes in the 50 largest U.S. cities.

Methodology

To determine how far you can go on the median income, we calculated the difference between the median income as reported by the Census and the Economic Policy Institute’s estimate for monthly expenses in the 50 largest U.S. cities. The expenses included in the monthly estimate are: housing, food, transportation, health care, taxes, other necessities, and child care (where applicable).

We crunched the numbers for three different scenarios: a single person household, a married couple household without children, and a married couple household with two children.

What we found was a great amount of variety in how far the median income will take you, particularly for single people and families with children. Read on to learn more about what we found.

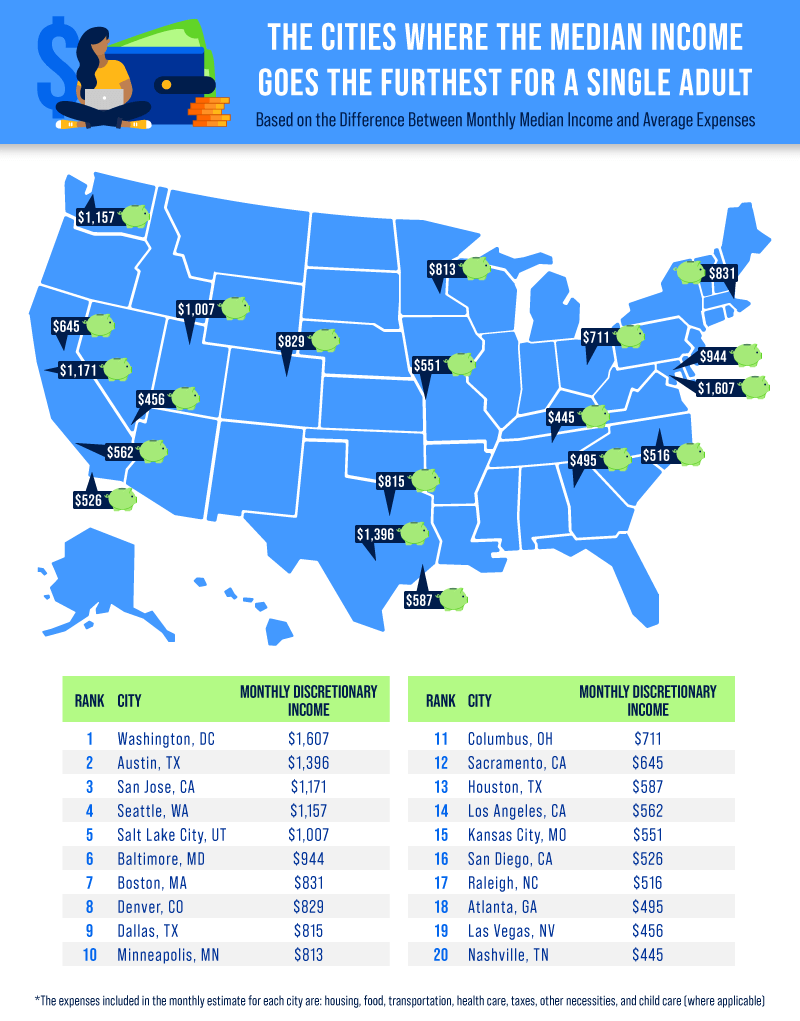

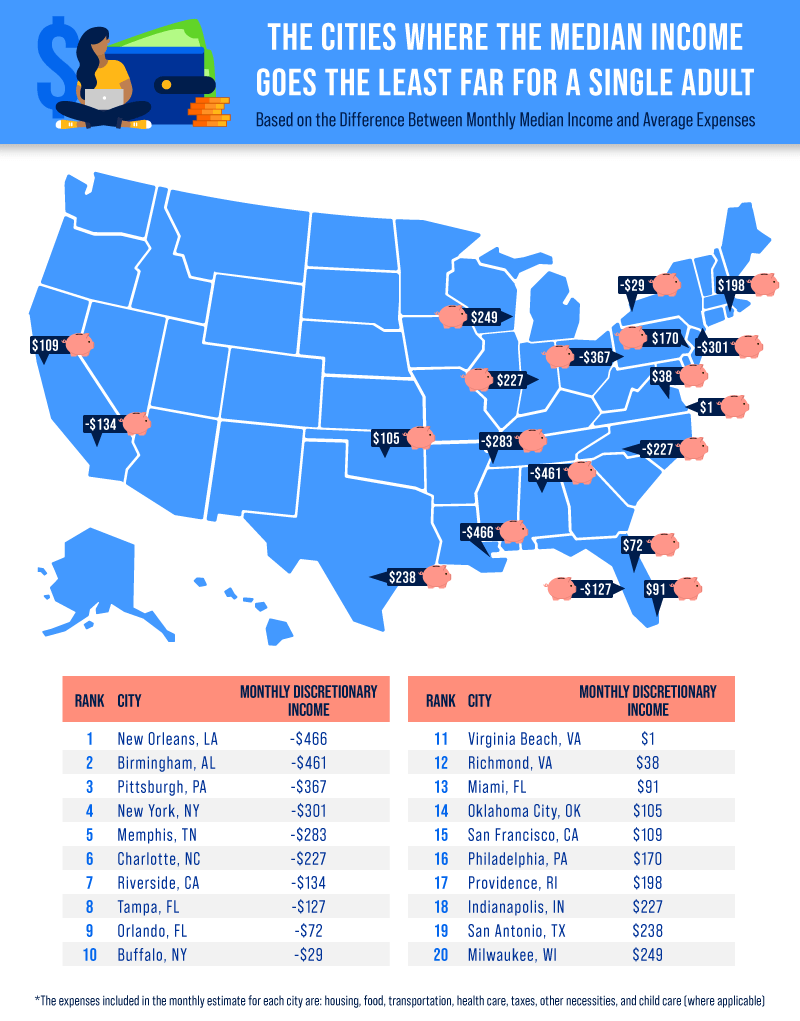

How Far a Single Person Can Go on the Median Income

We started by looking at the cities where single people could get the furthest with a median income. This is especially important for young people, many of whom are likely looking to move away from home after a year spent saving and living at home with their parents.

The city where individuals can go the furthest on a median income are Washington, D.C, Austin, TX and San Jose, CA. In each of these three cities, surplus incomes exceeded at least $1,150 every month. While these cities don’t necessarily have low costs of living, high-paying jobs in local economies like San Jose’s nearby tech sector create an environment where median incomes exceed monthly cost estimates for single people.

On the other hand, individuals in New Orleans, LA, Birmingham, AL, and Pittsburgh, PA go the least far on median income in terms of meeting monthly expenses. In New Orleans, a city which has been marked by financial hardship in the last decade especially, the median monthly income comes $466 short of monthly expenses.

It’s worth noting that individuals in these cities aren’t the only Americans whose median income doesn’t cover expense estimates. Of the 50 cities profiled, expenses exceeded the monthly income in 12 cities including New York, NY, Charlotte, NC and Orlando, FL.

You can check out the city-by-city statistics for single individuals in the table below.

How Far a Married Couple Without Children Can Go on the Median Income

Next, we calculated the difference in monthly income and expenses for married couples without children. After all, sharing expenses like rent and utilities with a partner can be transformative in household budgeting.

Indeed, the data showed that in the top three cities where median household income for married couples goes the farthest, surplus income exceeded at least $4,900 per month. Once again, the top three cities were Washington, D.C, Austin, TX and San Jose, CA.

An interesting statistic about the cities where the median income covers the least expenses for married couples without children is that no cities showed a deficit.

Still, the lowest-ranking cities like New Orleans, LA, Birmingham, AL, and Pittsburgh, PA had less than $1,250 leftover every month for discretionary spending and the savings that so many young married couples are trying to build up.

You can check out the city-by-city statistics for married couples without children in the table below.

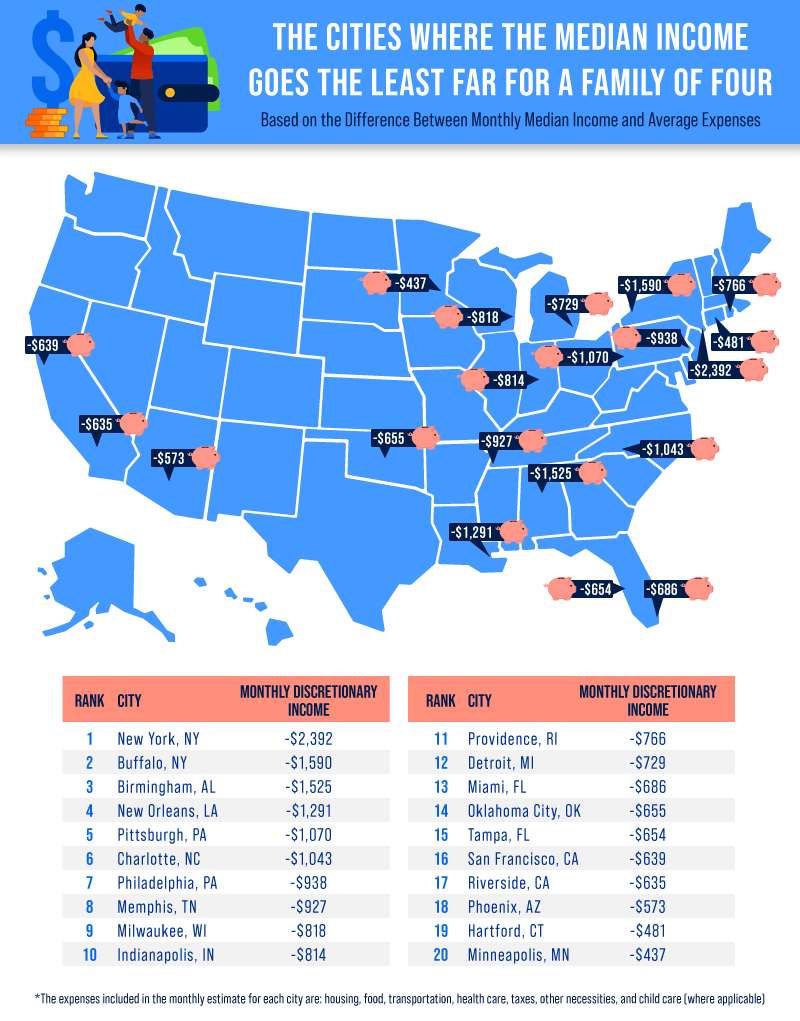

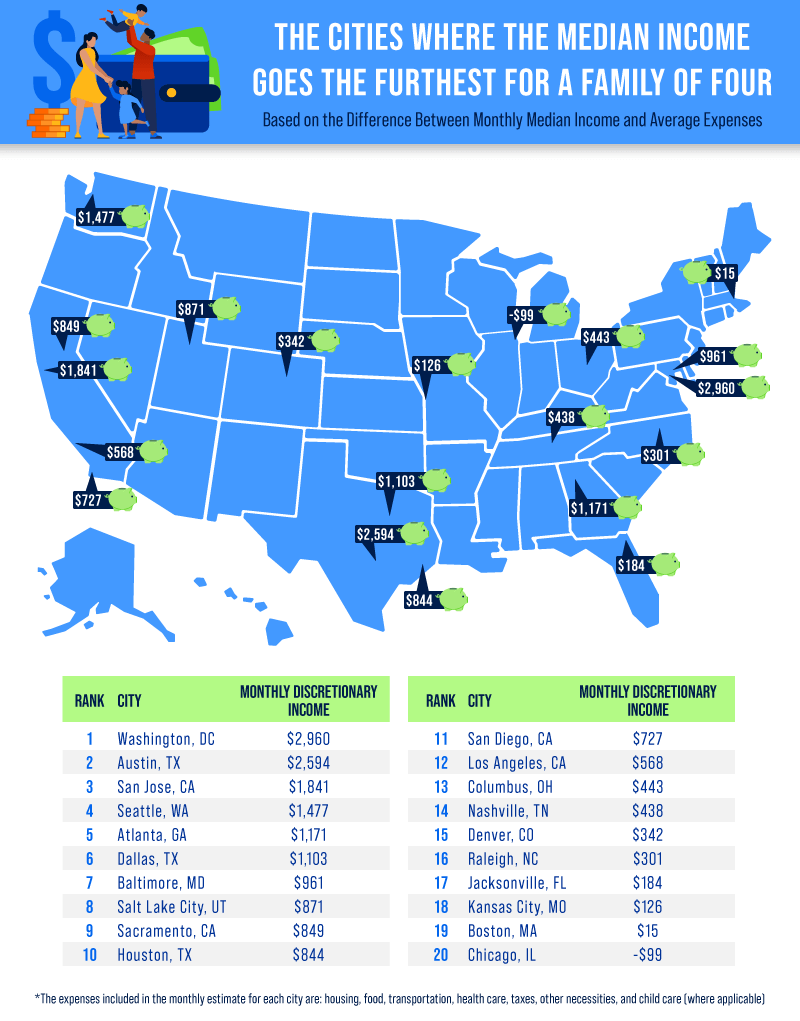

How Far a Married Couple With Two Children Can Go on the Median Income

Finally, we looked at the data for a two-parent, two-child family, and saw the most dramatic ranges in deficits and surpluses for any group of people.

On the down side of things, the cities with the greatest monthly deficit were New York, NY, Buffalo, NY and Birmingham, AL. In New York, monthly expenses for two-parent, two-child households were over $10,000, leading to deficits of $2,392 each month.

We also saw huge ranges between cities that are relatively close to one another. For instance, San Francisco and San Jose, only an hour’s drive apart, had a range of $2,480 in their leftover income with San Jose families having $1,841 leftover after expenses and San Francisco families falling $2,480 short of their estimated monthly costs.

You can check out the city-by-city statistics for married couples with two children in the table below.

Final Thoughts

This data illuminated the wide range of financial circumstances of different Americans, based on where they live and what their family looks like.

Overall, we found that, generally, married people without children can go the furthest on a median income no matter where they live. On the other hand, married people with children have the greatest financial surpluses in the country, but also see the greatest deficits. Finally we saw that even in cities with high costs of living, high median incomes led to surpluses in every family makeup.

As we attempt to move past the pandemic into situations of greater financial stability, understanding how your location and family size impacts your budget is crucial.

As business owners look for ways to build their businesses and maximize profits, Surety First is here to help, offering surety bonds and safety insurance services for contractors. We hope that having an understanding and honest community support will help us all go the farthest with our finances.

HAVE BONDING QUESTIONS?

Call us today at 1-800-682-1552 to speak with a licensed contractors bond specialist.

Mon-Fri 8:30am-5:00pm

Or