How Does Average Rent Compare to Average Mortgage Payments in the U.S. – A Study

In recent months, the housing market has been overwhelmingly favorable to sellers and equally unfavorable for buyers looking for their next home. This means that those who currently rent are continuing to do so, even if they want to buy, and those who are venturing away from the nest for the first time are more likely to rent than own.

What does this mean for homeowners? At Surety First, we know that keeping a property in great condition to attract renters isn’t easy. Owners must continually work with contractors to renovate and maintain their property. We work closely with contractors to provide bonds on contract services, holding them liable for completing the work and repairing any damage they may cause.

We also understand that on top of maintenance expenses, landlords have the sizable expense of their mortgage. So we wanted to find out—how much of a landlord’s mortgage do renters pay on average?

Methodology

To accomplish this study, we used publicly available data from Zillow for the 50 most populous cities in the U.S. Specifically, we determined the average rent in each city from Zillow’s Observed Rent Index and the average median home value using their Home Value Index. All data was collected from September 2016 to September 2021.

To calculate the median mortgage payment by city we used a mortgage term of 30 years, 4% rate, and a down payment of 6% of the median home values from Zillow. From there, we calculated each city’s average rent as a percentage of its average mortgage payment in order to determine in which cities renters pay the largest percentage of their landlord’s mortgage.

Read on to see what we found!

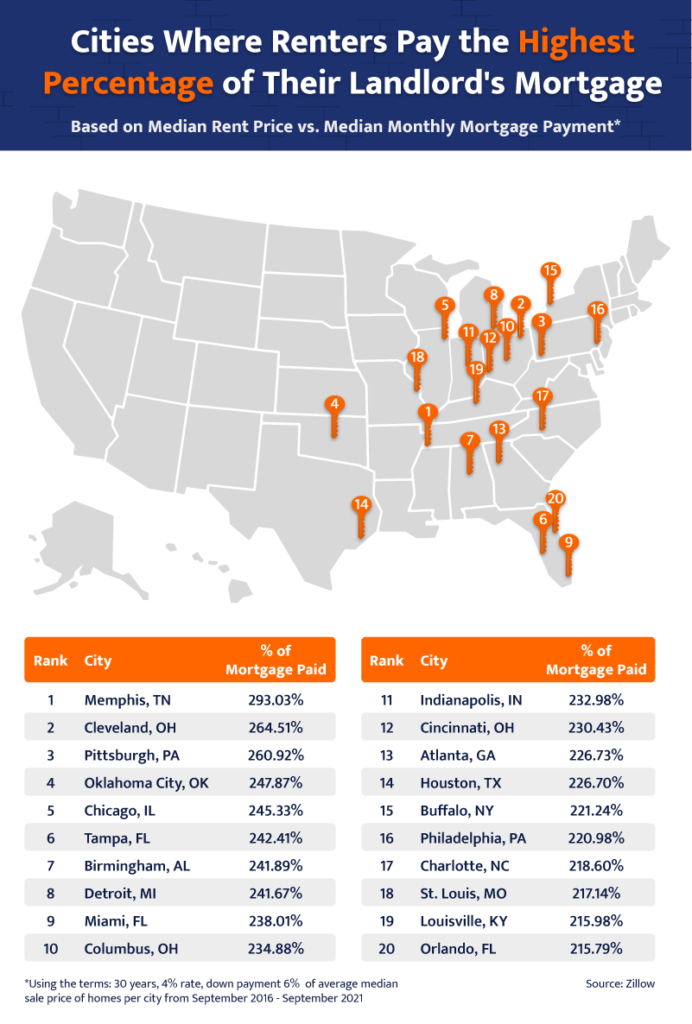

The 20 Cities Where Renters Pay the Highest Percentage of Their Landlord’s Mortgage

First, we looked at the cities that house residents who pay the highest percentage of their landlords’ mortgages. The results were shocking.

Renters pay more than 200 percent of their landlords’ mortgages in the top 20 cities where they pay the most. In twentieth place, renters in Orlando, FL, pay 215.79% of their landlord’s mortgages. The highest ratio is in Memphis, TN, where renters pay 293.03% for the same or similar accommodations.

Landlords in these cities might want to consider doing some renovations since they likely are not having any trouble finding tenants in this wild real estate market and are turning the largest profit in the country. However, not all landlords profit to this degree per tenant they house.

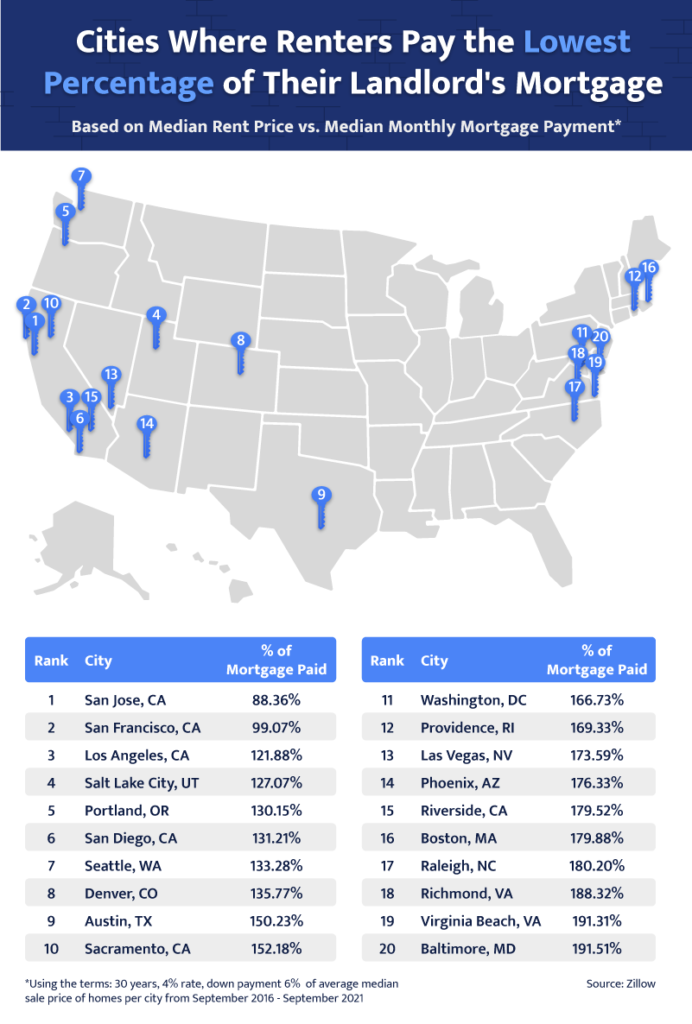

The 20 Cities Where Renters Pay the Lowest Percentage of Their Landlord’s Mortgage

Interestingly, some of the cities that ranked high on our list for low rent payments are actually large metropolitan areas where you’d expect rent to be high. For example, renters in Los Angeles, CA, pay just 121.88% of their landlord’s rent—pushing it to the number three spot on our list. Likewise, renters in other large cities are getting a relatively good deal. The average rent in Portland, OR, is 130.15% of the average mortgage payment. In Seattle, WA, it is 133.28% and in Las Vegas, NV, it is 173.59%.

Out of the 50 cities we analyzed, it is cheaper to rent than to pay a mortgage in just two of them. San Franciscan renters pay 99.07% of what they would spend on a mortgage payment and the rent-to-mortgage ratio in San Jose, CA spend 88.36%.

How Much of Your Landlord’s Mortgage You’re Paying as a Renter by City

Did you not find your city on the lists above? View our full dataset within a convenient bar chart below to find out how all 50 most populous cities compare when it comes to average rent payments as a percentage of average mortgage payments.

Closing Thoughts

It was interesting to discover the wide gamut in average rent payments compared to average mortgage payments across the most populous U.S. cities. Whether renters are paying less than the monthly mortgage payment or up to three times that amount makes a huge difference in the amount of cash flow a landlord has for paying utilities, maintenance operations, and renovations to the property.

Remember, if you’ve been contracted to complete work of any sort on a property, it is necessary to secure a bond to ensure proper completion of your work. Surety First provides the absolute highest quality products and customer service with the ultimate goal of helping our California contractor partners in building stronger, more profitable businesses through effective risk management. Get a quote today.

HAVE BONDING QUESTIONS?

Call us today at 1-800-682-1552 to speak with a licensed contractors bond specialist.

Mon-Fri 8:30am-5:00pm

Or