Money Matters – Are Americans Actually Financially Independent?

Let’s talk money. Some people have it, some people hoard it, and some people give it away. But one thing’s for sure—we all spend it. And with rising costs of living, inaccessible housing, higher education costs, and lower-paying post-graduate employment opportunities, today’s consumers may be stretching their dollars more than they’d like. But whose money really fills their bank accounts and covers their expenses? In 2019, Census data showed that just 24% of young adults could be considered financially independent by 22, compared to 32% in 1980. In the absence of their own savings and income, many Americans are relying on others for financial support—but just how much?

Methodology

To find out how financially independent Americans really are, we surveyed over 1,000 people across the U.S., exploring their financial arrangements with family and partners, as well as their perspectives on financial dependence and personal debt.

Read on to see what we discovered!

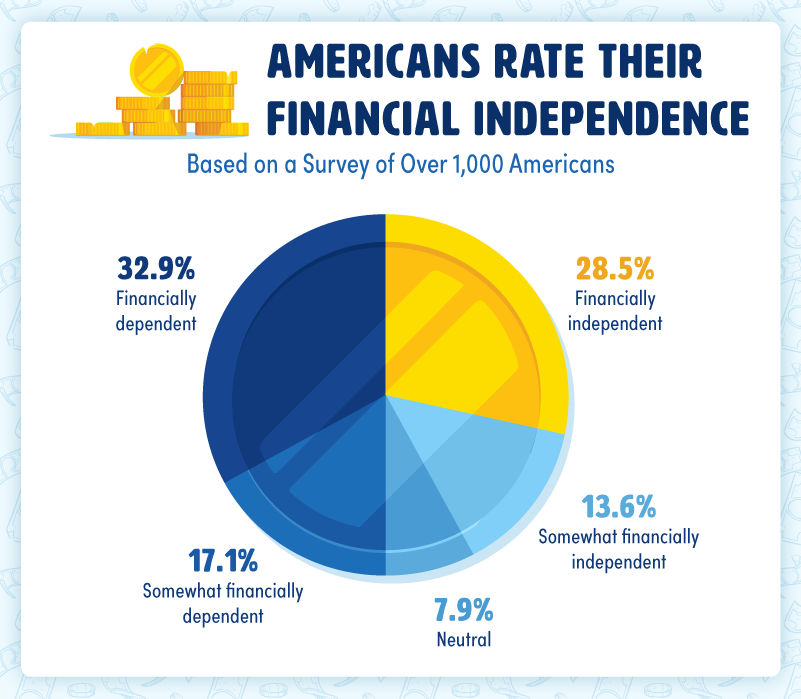

Americans Rate Their Financial (In)Dependence

Finances can be a touchy subject, especially when it comes to conversations with those we love. Looking to make any relationship just a little bit weird? Ask for money. If you aren’t a kid with a weekly allowance or a chore chart trading household duties for spending money (not to be that guy, but nobody should have to pay you to unload the dishwasher, Kayleigh), then seeking financial support from your parents or other family members can be uncomfortable. Relying on a partner or spouse for their income may be even more so. And the older we get, the more pressure there is to manage and maintain our own financial security.

Still, for many Americans, this is easier said than done. 50% of people consider themselves at least somewhat financially dependent. This number is even higher for millennials, a generation faced with slower economic growth, lower earnings, and more restricted financial milestones than any generation prior; 52% of adults aged 25-31 and 49% of adults aged 32-38 report financial dependence. We will see this trend again and again across the data with respect to millennials—financial independence is more easily accessed by other generations. Only 28.5% of all respondents confidently rated themselves as financially independent.

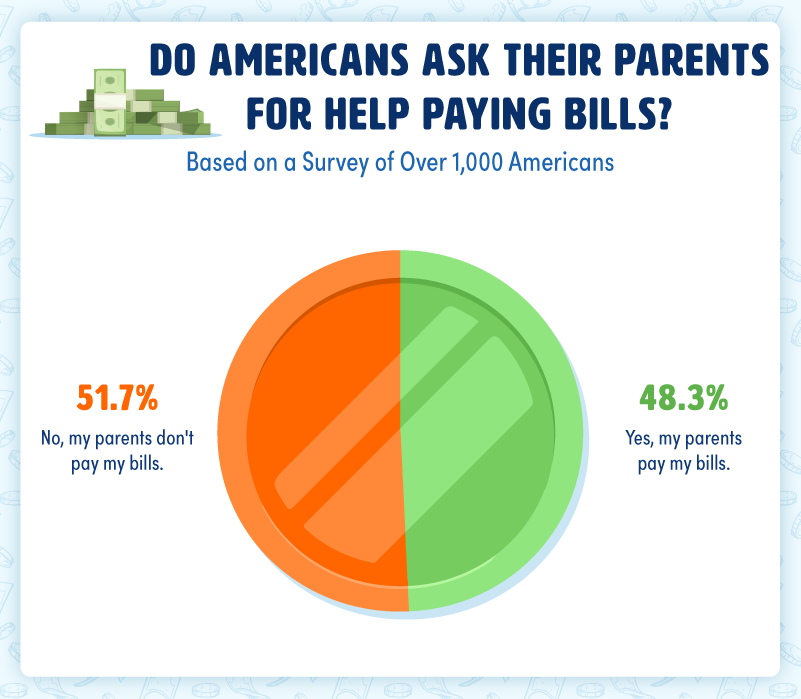

Help From Home

With low self-reports of financial independence but no fewer bills to pay, Americans are turning to their original investors—mom and dad. Almost half of survey respondents (48.3%) say their parents pay some or all of their bills. 50% of men receive help from their parents, while 55% of women keep their parents away from their living expenses. Again, we see relatively high percentages of those receiving parental financial assistance among millennials; 57% of adults aged 25-31 and 41% of adults aged 32-38 are still calling home for cash. 26% of all survey respondents cannot afford to pay their bills without parental intervention.

So, what bills are parents covering? Overall, basic living expenses like rent and utility bills take priority over extras like streaming services and car insurance, but our data revealed that millennials needed a bit more support across the board. 25% of adults aged 32-38 ask their parents to cover music streaming services, while another 20% seek help with their car insurance. 40% of adults aged 25-31 have their phone bills covered by their parents, and 39% of that same age group need help with rent.

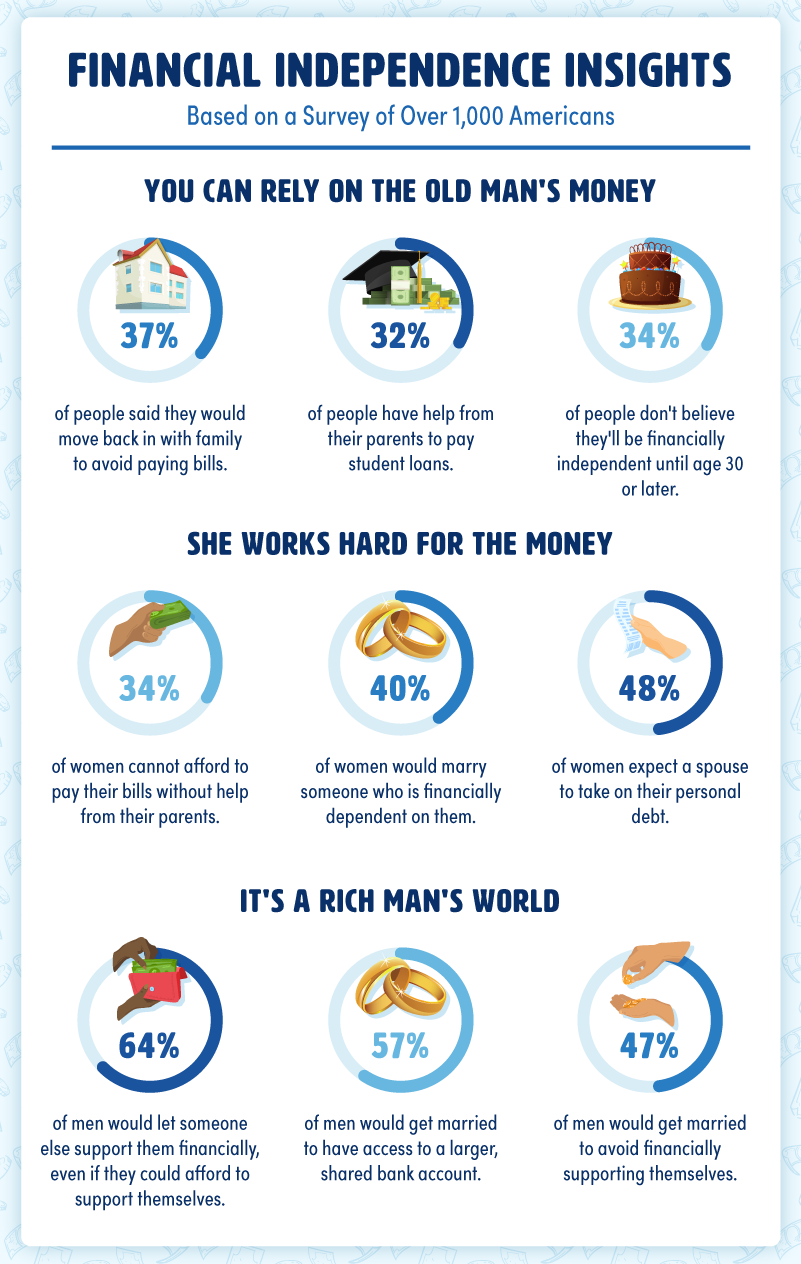

No Money, Mo’ Problems

Limited financial freedom has implications for the future, and some respondents may be paying off loans for years to come. 34% of people say financial independence isn’t achievable before 30 years old. And with 32% of respondents unable to pay their student loans without parental aid and 20% of people earning less than needed to cover their expenses, this isn’t entirely surprising. 31% of Americans feel barred from buying a house—a major financial milestone—due to their financial dependence on family, friends, or a partner.

While this reliance on the generosity of others may not be a choice for many people, there are others who simply see it as the easier option. A whopping 63% of people would let family members or a spouse financially support them even if they did not need the help. 46% of respondents expect a spouse to take on their personal debt. 53% of people would get married to have access to a larger, shared bank account, and 45% of people would tie the knot to avoid financially supporting themselves. Saying “I do” just got a little more loaded.

Final Thoughts

Many Americans reported relying on others at least somewhat for financial support, but it’s worth noting that this comes at the tail end of an unprecedented year packed with lay-offs, furloughs, business closures, and unexpected healthcare expenses. For today’s homeowners or home-buyers looking to be more mindful of their finances while upgrading a home, Surety First’s contractor bonds protect homeowners—and their money—in the event of a breach of contract. Next time you’re looking to upgrade your home, make sure to hire a fully bonded and insured contractor.

HAVE BONDING QUESTIONS?

Call us today at 1-800-682-1552 to speak with a licensed contractors bond specialist.

Mon-Fri 8:30am-5:00pm

Or