What Is A California Contractors Bond of Qualifying Individual?

A Bond of Qualifying Individual is a bond that serves as a legal promise regarding the compliance of the applicant to the relevant provisions of the California Business and Professions Code and the rules and regulations set forth by the California Contractors State License Board of the Department of Consumer Affairs.

According to contractors we have spoken with regarding license bond requirements, the guidelines pertaining to a Bond of Qualifying Individual (BQI) are certainly one of the more confusing topics. While many contractors will not require a BQI, those that do should carefully plan how their license is qualified, particularly if the parties to a license have credit blemishes or other license issues that could dramatically affect overall bonding costs for the business. Below is a short summary of what a BQI is and when it’s required for California contractors.

When Is A Bond of Qualifying Individual Required?

For a variety of reasons, some contractors may choose (or have no other choice) but to have their license qualified by another individual. When this occurs, some California contractors may be responsible for obtaining a bond of qualifying individual in addition to a contractor’s license bond as a condition for obtaining and maintaining an active license.

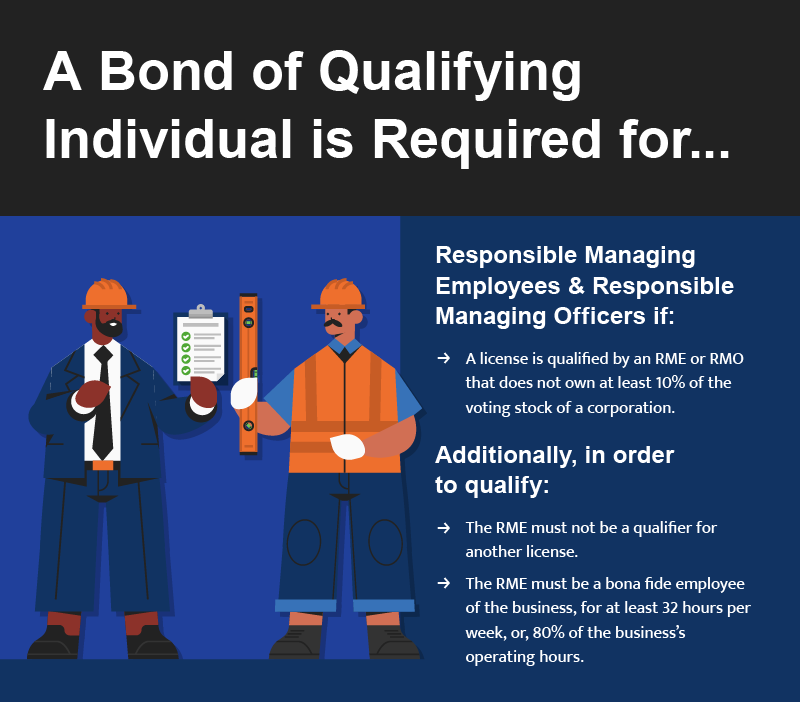

According to business and professions code 7071.9, a bond of qualifying individual is required if a license is qualified by a responsible managing employee (RME) or a responsible managing officer (RMO) that does not own at least 10% of the voting stock of a corporation. The CSLB also requires that any RME must not be the qualifier for another license and must be a bona fide employee of the business that is employed for at least 32 hours per week, or 80% of the businesses operating hours, whichever is less. Contractors that have a license that is not qualified by an RMO or RME do not require a Bond of Qualifying Individual.

What are the Responsibilities of an RME and an RMO?

Both a Responsible Managing Employee (RME) and a Responsible Managing Officer (RMO) are individuals who have proved their experience to the Contractors State License Board for the company they are qualifying. They are similar in that they do not own the licenses they are qualifying, and it’s possible for owners or partners to replace them without interrupting license status. Because RMOs hold an officer title, they can only qualify corporations or LLCs having ownership anywhere from 0 to 100%. RMEs, however, can qualify all types of entities, though they are listed as employees who require payroll and their company must file a Workers’ Compensation policy on the license.

How Much Does a BQI Cost?

For the most part, a Bond of Qualifying Individual is very similar in structure to a contractor’s license bond and is also in the amount of $25,000 at the time of this writing. As such, rates for BQI’s are evaluated by sureties in much the same manner as standard contractor’s license bonds. As with a license bond, BQI rates will largely be based on the personal credit profile of the indemnitor, which in this case is the RMO or RME.

Is a Credit Check Required for a California Bond of Qualifying Individual?

Yes. Surety companies will run a credit check on company owners to ensure their eligibility and determine pricing for the California Bond of Qualifying Individual. Contractors who have good credit standing and work experience can expect the best rates. Those without good credit will end up paying more or may even be declined. Do note that this credit check is categorized as a “soft hit,” meaning it will not negatively affect the contractor’s credit.

Can an RMO or RME Be Substituted?

While commonly requested, another individual with better credit cannot be substituted for the RMO or RME, nor can the credit of the corporation or business be used in lieu of the individual’s credit. With this in mind, businesses that require an RMO or RME should be aware that overall bonding costs may be much higher when a BQI is required, especially if the RMO or RME in question has poor credit. A solid plan of attack is for contractors to carefully review their bonding options in advance and evaluate all possible solutions. For more information on California contractor bonds, please click here.

What Happens if an RME or RMO Decides to Leave?

An RME or RMO leaving a company may affect license status if written notification is not received in a timely enough manager and the qualifier is not replaced within the required time allotment. When an RME or RMO leaves a company, a Dissociation Request must be completed and sent to the CSLB’s HQ office. The form must be received within 90 days of the dissociation date. Note that this request must be signed by a member of personnel listed on the CSLB’s records. Please see Business and Professions Code section 7068.2.

If the CSLB is not notified within 90 days of the dissociation date, the license will be automatically suspended or classification will be removed, effective the date written notification is received by the CSLB. If notification of the disassociation is not received within the 90 allotted days, the license record will reflect the qualifier’s disassociation date as the date written notification is received by the CSLB.

The RME or RMO is responsible for all work performed by the company prior to the recorded disassociation date.

How Do You Obtain a Bond of Qualifying Individual?

Pending you meet qualifications, you can obtain a Bond of Qualifying Individual from a licensed surety company. The requirements for a Bond of Qualifying Individual dictate that the bond must:

- Be written by a surety company licensed through the California Department of Insurance

- Be in the amount of $25,000

- Have the business name, license number, and qualifier name that corresponds with the CSLB’s records

- Have the signature of the attorney-in-fact for the surety company

- Be written on a form approved by the Attorney General’s office

- Be received by the CSLB HQ office within 90 days of the bond’s effective date

Surety First will gladly walk you through the process of obtaining a Bond of Qualifying Individual. Our work is reliable, timely, and trusted by many California contractors. To get a free, fast quote, click here.